The holidays are officially behind us. The tree is coming down, the lights are boxed up, and the playlists are back to normal. But for many people, the spending didn’t stop when the music did. Credit card balances are higher, buy-now-pay-later plans are stacked, and those “I’ll worry about it later” purchases have officially arrived.

If you shopped ‘til you dropped, tapped that card one too many times, or leaned hard into holiday convenience spending, you’re not alone. Seasonal debt is incredibly common—and it doesn’t mean you failed. It means now is the moment to get honest, get focused, and get a plan.

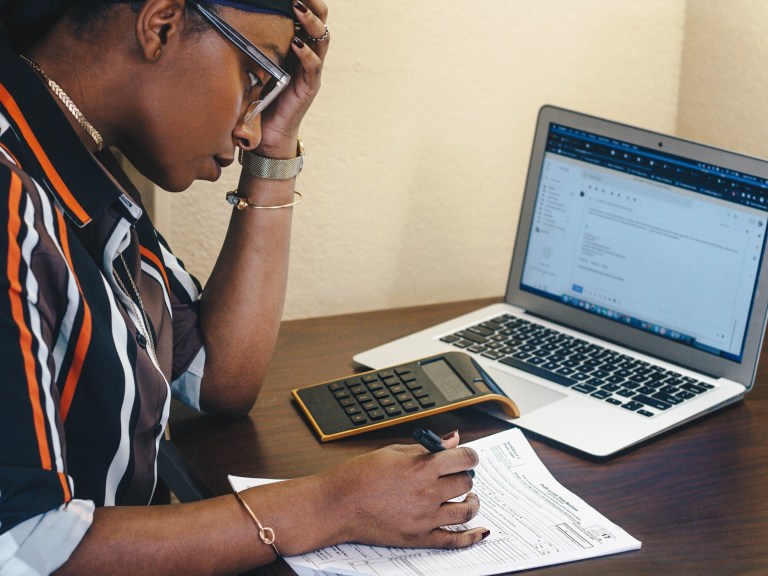

The hard part comes after the holidays: figuring out how to recover without feeling overwhelmed or ashamed. That’s what tonight’s conversation is all about how to climb out from under holiday debt, regain control of your finances, and build smarter habits before the next swipe.

We’re talking real-life resets, not financial perfection. That means looking at what you owe, understanding where your money is actually going, and learning how to prioritize payments without sacrificing your peace. It’s about shifting from reactive spending to intentional decisions, one step at a time.

We’ll also discuss how to refocus your mindset for the new year. Moving into 2026 with discipline doesn’t mean deprivation. It means setting boundaries, knowing your numbers, and making choices that support your future self. Less stress. Less debt. More clarity.

To help guide this conversation, we’re joined by Muriel Garr, a respected Financial Education Expert who specializes in helping everyday people make sense of their money. Muriel brings practical advice, not judgment—and tools you can actually use whether you’re paying off a little debt or a lot.

Together, we’ll break down:

- How to assess holiday debt without panic

- Smart strategies to reset your finances after overspending

- Ways to develop healthier money habits that last all year

- How to avoid repeating the same cycle next holiday season

This isn’t about guilt, it’s about growth. If you’re ready to reset, refocus, and move forward with more confidence and less debt.